Welcome to the Grain Trading Crash Course (GTCC). This is a free course presented by GrainStats.com for anyone who is interested in the grain markets. Whether you’re a seasoned pro or a newbie, there is something for you in this course. Feel free to share the knowledge gained from this series and pass it along to your students, friends, family, and co-workers.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Getting Started 🕵️♂️

When I first entered the grains markets as an outsider I didn’t even know where to begin. I started like everyone else who has an interest in anything these days - by searching Google. I recall searching for “grain markets” and “grain trading” and immediately the first page of results filled my screen with links to grain futures quotes, farming magazines, futures brokers, and the United States Department of Agriculture (USDA). Those results weren’t exactly bad, but they weren’t the best search results one can ask for when getting started in the grain markets.

Looking back, what I should have done was to search for simpler queries such as,

What are the biggest agricultural crops?

What are soybeans used for?

What’s a bushel?

Although those search queries sound elementary, they will actually put you on a better trajectory to learn about grain markets from the ground up.

That being said, before we get into the fun trading topics that you really want to hear about, we have to get the basics down. That requires an understanding of what grain actually is, what it’s used for, where it comes from, who the players are, and how it is transported. All of these elementary inquiries will be the building blocks for what’s to come in this course.

Grains & Oilseeds 🌾🌱

It seems whenever the industry references the "Grain Market”, we typically leave out the “Oilseed” part of it. For whatever reason that is, we will follow along in this manner when it makes sense to. However, that is not to say grains and oilseeds are the same - they most definitely aren’t.

Grains, such as wheat, rice, corn, oats and barley, are primarily grown for their seed, which is used as a source of carbohydrates and other nutrients.

Oilseeds, such as soybeans, canola, sunflower, and flaxseed, are primarily grown for their oil content.

Above and below you can see what several of the major grains and oilseeds look like in the field. Depending where you have grown up in the world, some may be more common than others. Some of these grains may be completely foreign to you, as they were to me when I started my career in grain trading.

For example, I grew up in a Corn and Soybean producing region in the Midwest. It would only be until my early 30’s when I saw my first sorghum field while on vacation in Texas. It was a weird feeling for me because two years before seeing that field in person, I had traded several million bushels of sorghum not knowing what it even looked like outside of Google image search results. 😳

What are grains and oilseeds used for? 🐷

All grains and oilseeds are primarily used to meet the following demands:

Food & Alcohol

Key ingredients in bread, pasta, beer, vodka ,starches, cooking oils, flour, salad dressing, and sweeteners. Check the back of any food nutrition label and you might see several of the grains and oilseeds mentioned already.

Feed

Used as feed for livestock, poultry, swine, and fish. It can also be used to feed wildlife (e.g. Deer corn, bird seed).

Energy

Once grain or vegetable oil is converted into a biofuel, it can be blended with gasoline or diesel. Examples of biofuel include ethanol, biodiesel, and renewable diesel.

Before most grains and oilseeds can be utilized as food, feed, or energy, they have to be processed, milled, refined, or crushed. Using industrial means, grain and oilseed processors source raw grains and oilseeds and process them by crushing or grinding them, removing impurities, or refining them further into finished goods or additives before they land on your dinner plate or in your gasoline tank.

Top Crops 🏆

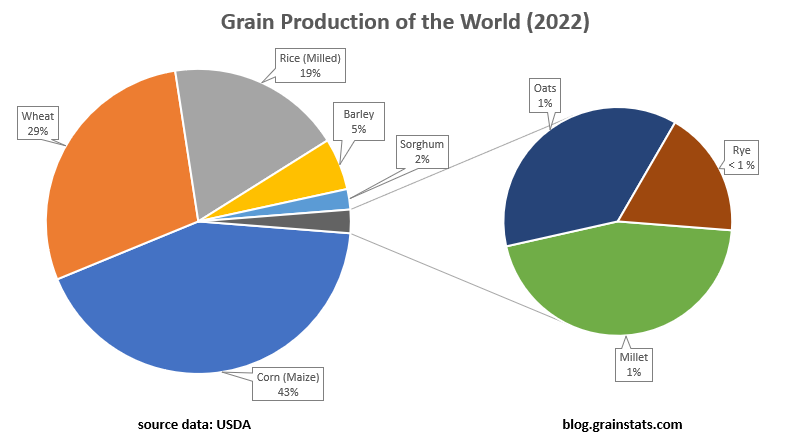

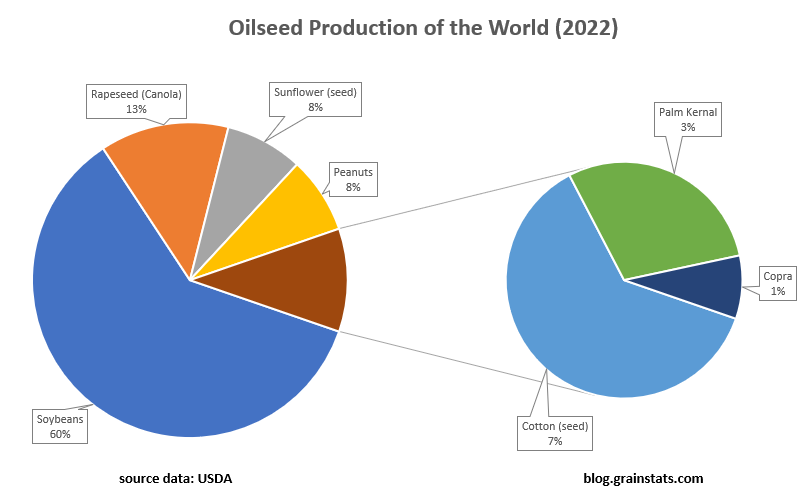

As mentioned earlier, there are many different types of grains and oilseeds being cultivated around the world, but which ones are the most abundantly produced? 👇

For the interests of this course, we will be focusing on the main grain and oilseed crops going forward - Corn (Maize), Wheat, Rice, Soybeans, and Rapeseed (Canola). In the next lesson of this course, you’ll find out why.

Where and when do grains grow? 🌍

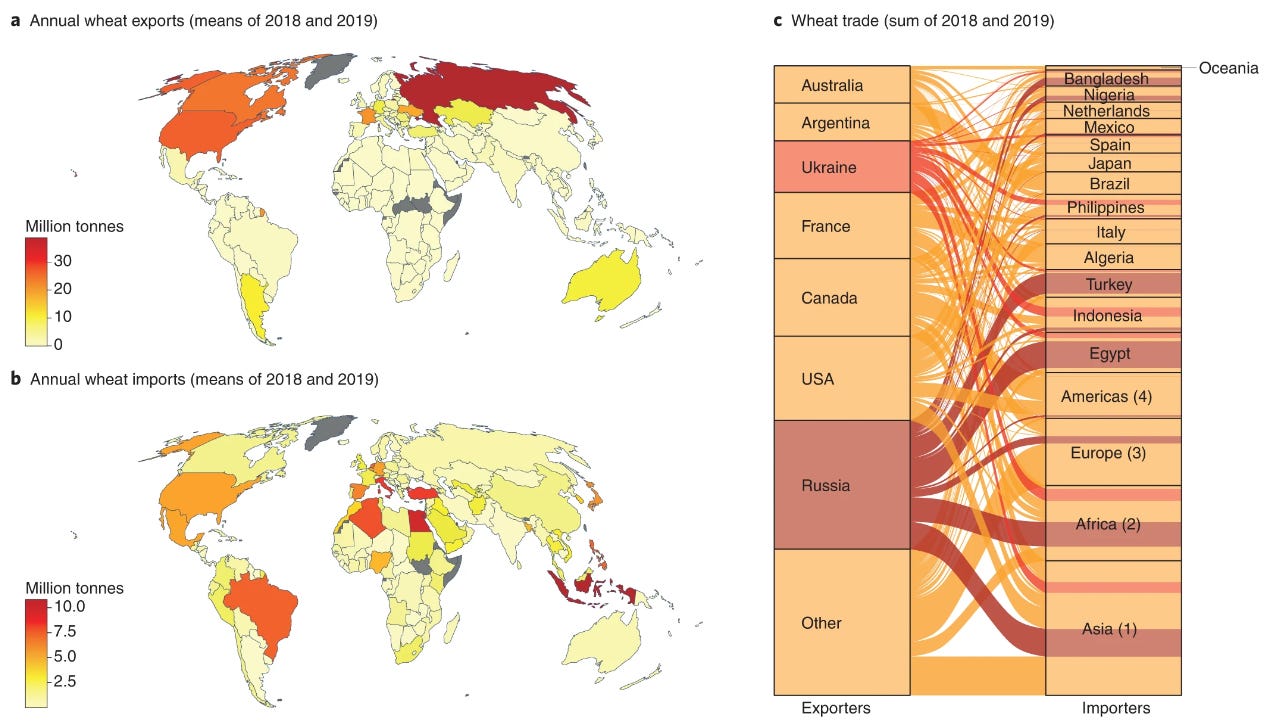

Grains are grown worldwide, but due to geographical, political, and financial limitations, they aren’t grown in abundance everywhere. For that reason, there is a need for trade to emerge from the countries that can produce excess amounts of grain to the countries that cannot. For example, the image below illustrates how Wheat flows worldwide from major exporters to importers.

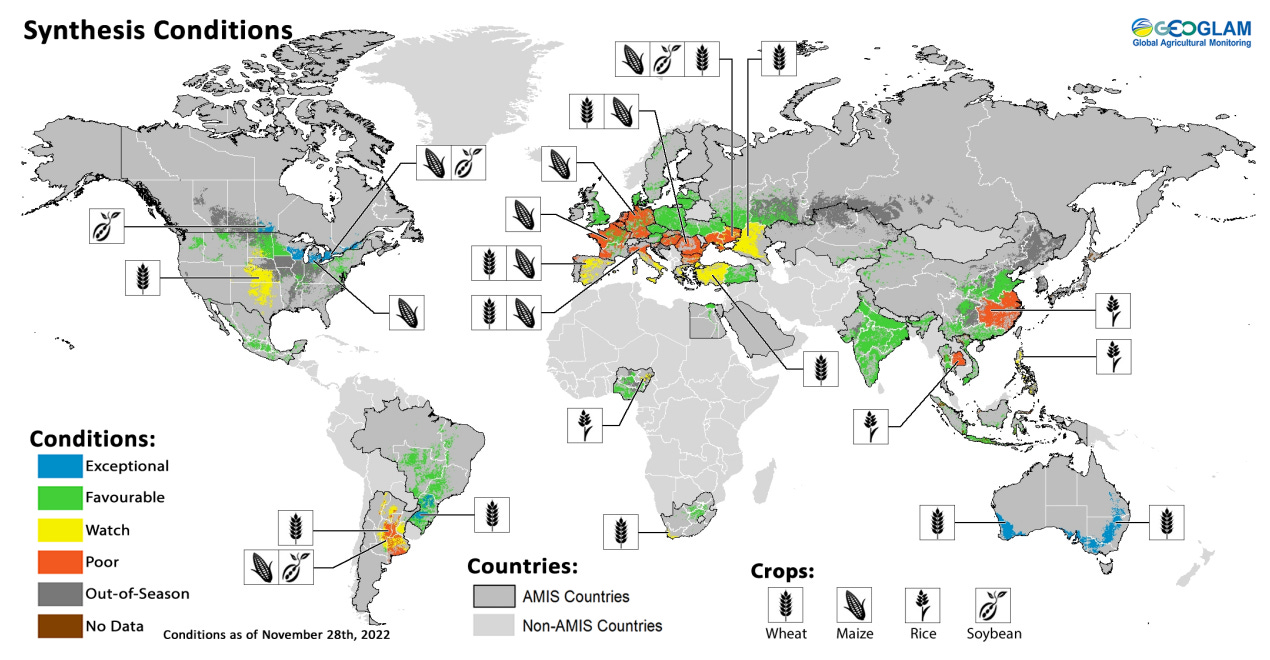

Other examples of major growing regions for Corn, Soybeans, Wheat, and Rice can be found on map below.

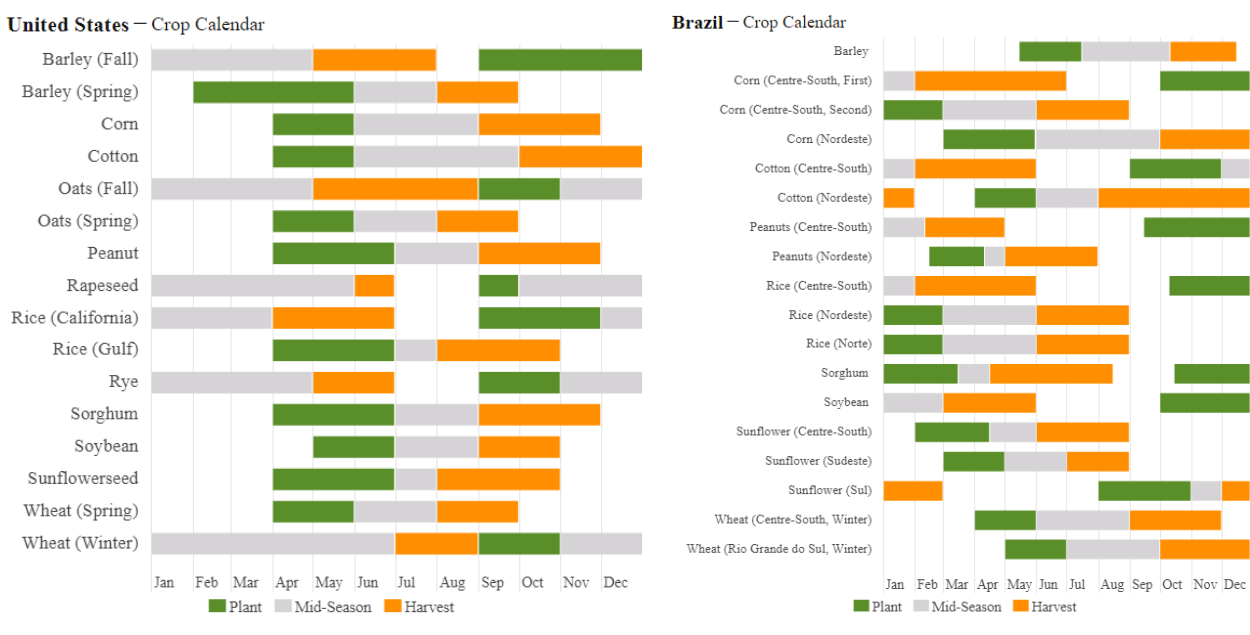

Note that many of the major growing regions of the world are at odds geographically with each other when it comes their growing seasons. For example, it’s currently January in the United States. It will be at least another three months until the majority of Corn and Soybean planting will start to take place on US soil. By the time the US farmer starts planting, farmers in Brazil will have already harvested their Soybean crop and planted Corn.

Below you can see the difference between crop calendars in the US and Brazil illustrating the points above.

On the same topic of crop calendars, grains and oilseeds have marketing years (MY) associated with them. This is similar to your typical calendar year January through December, except it is used specifically for each grain or oilseed to segregate one year of crop production from another.

For example, the current Wheat Marketing Year in the US started June 1st, 2022 and ends on May 31st, 2023. It can be abbreviated as 2022/23 MY or 22/23 MY for short.

Marketing years are determined by the harvest start date. Below are the main marketing years for various US grains and oilseeds.

June 1 to May 31 - Canola, Barley, Oats, Wheat

August 1 to July 31 - Cotton, Peanuts, Rice

September 1 to August 31 - Corn, Sorghum, Soybeans

As you can imagine, marketing years do not synchronize around the world due to the differences in harvest timing. Consider this as a positive feature of the grain markets as it allows for new supplies of grain to enter the market several times per year, thus helping to alleviate supply shortages when they occur.

How is grain transported?🚚

If you’re going to be dealing in the grain trade, you will need to know and understand how grain moves. Transportation is integral to the trade because where the grain originates from (the farm) isn’t where the majority of the demand is.

Below are the various modes of transport grain is transported in.

Barge - Used for transport in river systems. Most commonly grain loaded onto barges will be transloaded onto export vessels or unloaded into grain export elevators.

Container - Typically used for loading specialty grains that will be moved to an export market by ways of a container ship.

Truck - The most common form of transporting grain. You can utilize trucks almost anywhere to load and unload grains.

Railcars - Used when grain needs to move in bulk and over long distances inland.

Vessel - Where trucks and rail cannot go, bulk vessels are used for sea and ocean going voyages.

We mentioned the word transload above, what that means is the transferring of grain from one mode of transport to another mode of transport before ending up at a final destination.

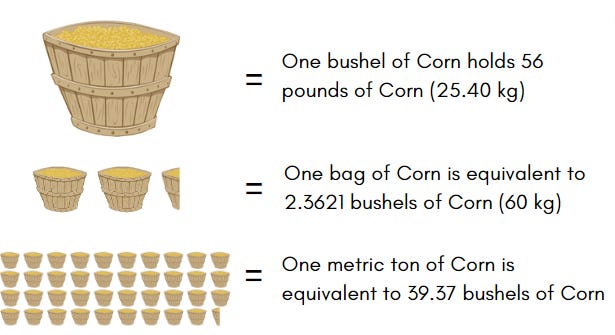

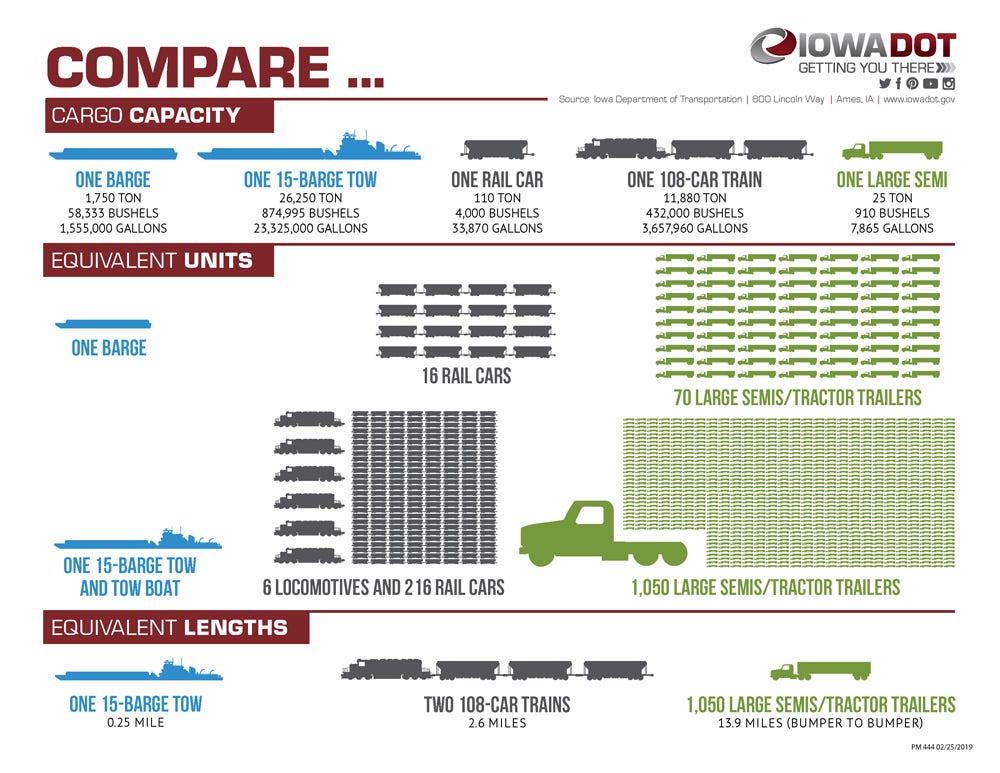

One final note regarding transportation: Depending where you are in the world, the common language for the grain trade is to denote grain in bushels, bags, tons, or metric tons (tonnes). If you’re like me, these mean nothing without visualization, so we created the following image demonstrating some useful conversions.

Now that you can grasp what a bushel is, take it a step further and study the following infographic of the capacities of the various forms of grain transport in the US transportation system. They will come in handy in the following lessons.

Who are the players? 🔠

The grain game is not a single player game. Unless you’re strictly a financial player of the grain markets, you will have to rely on other entities in the market to make trade happen.

Below are the main players of the grain markets.

Brokers - Whether they are brokering physical grains or financial contracts, brokers connect buyers and sellers with each other or directly to the market itself. Their job is to ensure that trade happens, keep their customers informed, and to advise their clients of potential opportunities in the market.

End Users - These are physical demand centers for grain that could be anything from feedlots to ethanol plants. End users take grain and process it to create new products. They are a natural short in the market as they need to be buying and processing grain as it is the key ingredient to their operation.

Farmers - It all starts at the farm. Farmers are the first owners of the crop they harvest and have many cards to play when it comes down to marketing their grain. For this reason, they are the natural long in the market as they are frequently making decisions on how and when to market their crop by selling it to end users or merchants.

Investors - In the financial markets, investors can range from large mutual funds to individual investors typically playing the long side of the market. Investors use financial products tied to the price of grain to diversify their portfolio, which can reduce the overall risk of their portfolio.

Merchants - Not exactly a natural short or a natural long in the market, merchants are more like brokers, except they are the ones physically buying and selling grain. Merchants buy grain from the farm or from other merchants and sell it to end users or to other merchants involved in the grain trade. It is popular in the trade to call them the ABCD merchants, which is an acronym that stands for ADM, Bunge, Cargill, and Louis Dreyfus, who own and manage much of the grain infrastructure of the world. ABCD aren’t the only merchants in the market, but they certainly are some of the largest of the merchants in the trade.

Speculators - Like merchants, speculators are not exactly a natural short or a natural long in the market. Speculators can play any side of the market they wish to, but are confined to the financial side of the grain markets. Speculators include Financial Traders, Proprietary Traders, and Hedge Funds - to name a few. Although they go by different names, speculators are all tasked with profit maximization of their trading portfolio by speculating on the price of grain, long or short.

We mentioned a couple terms in bold that require some explanation for those who come from a non-financial background. Below are some useful definitions.

Long - When you purchase or own something you are long that item. In the case of farmers, when harvest is complete, farmers are holding onto the grain they harvested giving them a long (+) position in that grain. As they sell their grain, farmers will unwind their long position until they are flat (no position).

Short - When you don’t own something, you are short that item. In the case of an end user, they are constantly buying grain to cover their short (-) grain position. By buying (+) grain, they fulfill their short (-), thus leading to a neutral or flat position (0) for a certain period until they need to cover their next short.

Closing Time ⏲️

This concludes the first lesson of the Grain Trading Crash Course. From this lesson you have the building blocks necessary to start understanding how the grain trade operates. Although some of this may have seemed elementary, all of the topics mentioned above will be repeated over and over again and built upon in more detail in later lessons.

We hope you enjoyed this lesson, don’t forget to subscribe below to be notified when the next lesson will be published. Thanks!

Thank you for publishing this!

I don't know how can I thank you