Welcome to the Grain Trading Crash Course (GTCC). This is a free course presented by GrainStats.com for anyone who is interested in the grain markets. Whether you’re a seasoned pro or a newbie, there is something for you in this course. Feel free to share the knowledge gained from this series and pass it along to your students, friends, family, and co-workers.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Background ✅

We’re kicking off the trading and risk management section of the Grain Trading Crash Course today. This section is going to be the most market heavy and practical portion of the course. What you will learn in the next several lessons will prepare you to understand what are the price drivers of the market, how to analyze and price agricultural commodities, and where to gather inputs to justify your trading decisions.

Even if trading isn’t a career goal, these skills can be applied to various roles in the commodity trading industry, such as risk management, marketing and research/analysis.

Notes:

It is highly recommended that you review previous writings of the Grain Trading Crash Course to assist you with this and subsequent lessons.

The first part of the trading series (Trading Part I) is intended for those interested in starting their trading journey. It focuses on how newcomers can get better prepared and informed about what trading is by comparing it to something that mostly understand - videogames.

For intermediate to advanced topics on trading and price analysis (fundamental or technical), look forward to the upcoming lessons of the course to be released.

Introduction: Video Games & Trading 🎮

Do you remember your first video game?

I definitely do.

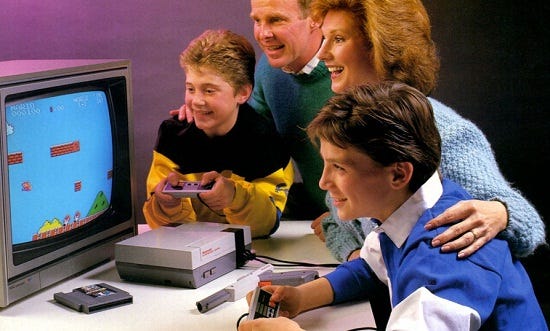

It was sometime in the late 1980s that my brother and I received one of the best Christmas🎄 presents a kid could ask for, a Nintendo Entertainment System (NES).

We ripped open the box and pulled out the console, but couldn't figure out how to connect it. Thankfully, our mother did all the work (thanks, Mom!🙏)

As my brother and I were waiting anxiously for our Mother’s help in connecting the systems controllers, video cables and power cable, we were admiring the video game that was prepackaged with the Nintendo - Super Mario Brothers - the iconic game about two plumbers (Mario and Luigi) who travel through the Mushroom Kingdom to rescue Princess Toadstool. (it sounds weird I know, but it became Nintendo’s best selling franchise!)

Once the system was fully connected, my brother loaded the Super Mario Brothers cartridge and pressed the power button, unaware of how it would forever change our lives.

From the moment we powered on the Nintendo, we were hooked. We played for hours that day, but I didn’t get to play as much because, as a 3-year-old (estimate), I found the gaming controller too uncomfortable to handle.

Regardless, that didn’t stop me from observing my brother playing and learning how the game was played 💡

I watched as he would smash bricks, collect coins, and defeat the bosses of the video game only to lose and start the game over again.

I noticed that after every loss, my brother would improve his ability to progress further in the game as every loss was a lesson learned for the next attempt 💡

This went on for hours until we finally beat the game and felt a wave of satisfaction, but it didn’t stop there. There would always be new and challenging games to conquer — everything from fighting games to role-playing games, each with its own system of keeping score.

So what does all this have to do with trading? 🤔

A lot, actually.

Trading and video games share many similar characteristics.

Both involve competing against many other players to win 🤼

Both use a scoring mechanism, whether it's points 💯 or money 💵

They have no true ending (someone will always outscore you) 👾

Both are designed with the potential to either win 👍 or lose 👎

Both have rules, some of which can be exploited 👀

They require problem-solving skills 💡

They cost money to play 💰

Where trading and video games differ is the score.

In video games, the score has no monetary value 💯

In trading, the score represents monetary value 💰

I want to emphasize these important points: while trading can be seen as a game, it's a serious endeavor with significant consequences, as it involves real money 💸

This is how I view and relate to trading and why I got into it in the first place. The allure of swapping a “high score” with “massive profit” came to mind when deciding my career path long ago and I figured I would give it a shot.

I will say today that the preconditioning from video games was a chip on my shoulder. It helped most definitely when I lost one million dollars of profits in one week when I was a interest rate futures trader. That loss was the largest loss on record I have ever made and that week ended up being the most dark and difficult week of my life. (I was only 22 years old at the time!)

Luckily for me, I was able to look past that loss, bounce back and start making money consistently only to deliver one of the largest PnL’s at the firm that year.

PnL or P&L is the Profit and Loss of a portfolio or account.

This preconditioning from playing video games was beneficial for me, though it's not a necessity, of course. However, I've observed that those who have experience in playing video games, sports, card games (including gambling), or board games (such as chess) often have a significant edge in trading compared to those who haven't.

Regardless of the background, the crucial aspect of all this is learning how to handle loss, accept it, and move on. This responsibility lies with You. Our role is to teach you how the game is played and that's precisely why this course was created.

So let’s get it started! (slowly)😎

The Trading Game 📈

Whenever someone inquires about trading or how to get started, my advice is always the same: the easiest way is to begin by simply observing markets, then jumping in when it is safe to do so.

Thanks to advancements in technology, observing markets has become easier and more affordable than ever before👇

Back in the day, obtaining a similar market terminal would have cost anywhere from $100 to $500 a month.

Today? F R E E! 👀

"The application shown above, TradingView, is a free tool that enables you to view delayed market prices and create charts. I personally have been using TradingView extensively since 2017 for all my charting and market analysis needs

For the purpose of this course, we recommend that you install TradingView on your mobile phone or desktop computer and follow along. You can even upgrade to a premium account, which offers numerous advanced features and the option to access real-time futures data for only $5 a month. (Otherwise, grain futures data is delayed by 10 minutes.)

Click here or the link below to sign up!

Let’s quickly go over a few key items on the TradingView screen 👇

Trading Symbol

The trading symbol for the desired instrument - whether it is stocks, futures, bonds, or even cryptocurrencies.

Watchlist

A list of contracts or markets I am currently watching.

My current watchlist can be copied using this link.

Contract Name & Month

The “decoded” name of the contract (ZSH2024), Soybean Futures (March 2024)

Price Axis (Y-Axis)

The price in cents per bushel.

Date/Time Axis (X-Axis)

The time period of the study.

This can be changed to your desired time frame, anywhere from months to seconds.

Volume

The total volume traded (in contracts) for that contract in the designated in the time frame. This will adjust with whichever time frame you desire.

Price History

The price history for the given time frame.

Price Change

The price change for the day from the prior day’s settlement price.

OHLC

Open - The opening price where the market first traded for the time frame.

High - The high price for the time frame.

Low - The low price for the time frame.

Close - The closing price for the time frame.

Contract Details & News

More information regarding the contract including forward curve, news, and performance metrics.

Price Last Traded

The last traded price for the session.

Overall, it can be a lot to handle for first time users, but everyone seemingly gets adjusted to it the longer they use it, similar to video games 💡

Experimentation 📈📊

Now that you are a bit more comfortable with the layout of TradingView, you can begin to experiment a bit more with some features like chart types and time frames 👇

Notice that in the demonstration I selected both candle (candlestick) and line charts.

Line charts display the Closing Prices of the instrument

Candlestick charts display the Open, High, Low, and Closing prices (OHLC)

Generally, traders find candlestick charts more valuable than line charts, though they are somewhat more challenging to read for newcomers.

Below, you can see how a candle can incorporate all of the OHLC prices into a single datapoint on the chart. This is extremely useful, as traders closely monitor where contracts open, close, and the range of prices within a specific timeframe

Observe that the candlestick is either green or red. These colors indicate whether the price change is positive (green) or negative (red) for your selected time frame.

Homework Assignment📚

Now that you’re setup with TradingView, experiment with the platform.

A few things you can consider doing:

Build a watchlist (or use ours)

Explore trading ideas (see our profile for details)

Customize your background on charts (night mode for example)

Play around with the indicators and add them to the charts (Moving Averages, Open Interest, etc.)

Remember, trading is not enabled on the platform out of the box, so you cannot lose any money trading on it unless you connect it to your brokerage account. (if your broker supports it)

Closing Time⌛

This concludes Trading: Part I of the Grain Trading Crash Course. In the next lesson of this course we will get into more intermediate topics such as margin accounts and trading mechanics.

I hope you enjoyed this lesson and hope you can see the parallels that I see when it comes down to trading and video games. If you don’t, you’re not looking hard enough! 😉

While this was super basic so far as candles and such, this was really good. Thanks for sharing.

Ow, rigth! Where the second round? Dont't stop, pls.