Welcome to the Grain Trading Crash Course (GTCC). This is a free course presented by GrainStats.com for anyone who is interested in the grain markets. Whether you’re a seasoned pro or a newbie, there is something for you in this course. Feel free to share the knowledge gained from this series and pass it along to your students, friends, family, and co-workers.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Background ✅

This is the fourth and final installment of the futures component of the Grain Trading Crash Course. In previous lessons we focused primarily on educating you how to read futures contracts, understand futures contract specifications, and how to read the futures market curve.

In this lesson we’ll be going over several important talking points that commodity futures traders need to know and understand regarding the rules of the game.

It’s important to note that all of these points build on each other in a general framework. This framework doesn’t guarantee success or profitability in trading, but it does provide a concrete foundation to understand how futures markets operate and helps to minimize mistakes that can cost you or your firm thousands, if not hundreds of thousands of dollars in tuition.

(Trust me, these mistakes happen more regularly than you think!)

Let’s begin✌🏻

Push it to the Limit ⬆️⬇️

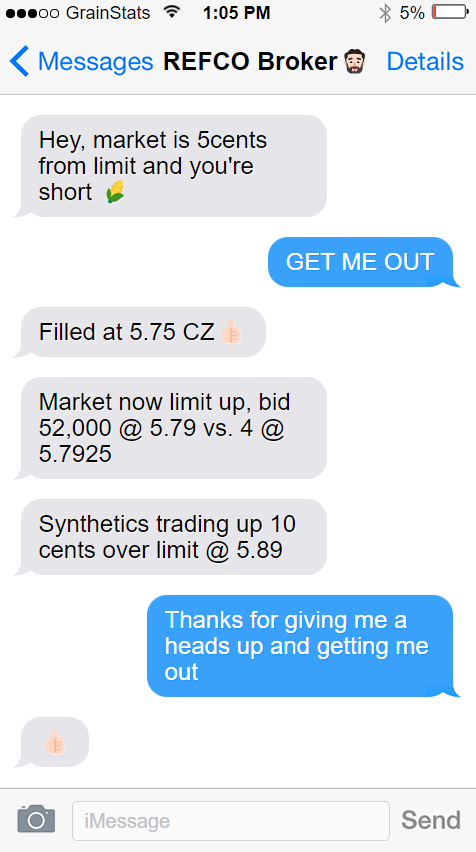

One of the best and worst things a futures trader ever wants to hear is the market they are trading about to go limit 👇🏻

This text message above describes a fictitious trader having a short position in the Corn futures (🌽) market. Unfortunately for the trader, his broker informs him that the market is within striking distance of going limit. This threat of the corn futures market going limit was enough for this trader to exit his position for fear of something worse to come.

Let’s explain 👇🏻

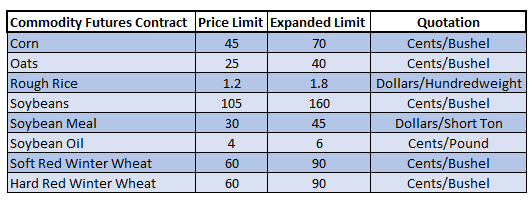

Futures contracts on exchanges have price limits that are set by the exchange itself. These price limits do not allow for futures prices to trade above or below whatever the price limit is for that day. This price limit is based on the prior day’s settlement price plus or minus the price limit. Below are the current price limits and expanded price limits for the most popular grain futures contracts.

When price limits are reached on a given day, they are called limit moves.

Limit moves come in two varieties👇🏻

Limit Up ⬆️ Occurs when futures prices trade the highest price limit for the day

Calculation: Prior day’s settlement price + Price Limit

Limit Down ⬇️ Occurs when futures prices trade the lowest price limit for the day

Calculation: Prior day’s settlement price - Price Limit

When limit moves occur, the market is pre-programmed not to allow futures prices to trade above or below the limit on any given day. This can cause market participants to grow increasingly nervous whenever the market is approaching limit and not in their favor.

So what causes limit moves? 🤔

The root cause for a limit move is an unexpected shock to the supply and demand situation of a given commodity. For example, in February 2022, when Russia invaded Ukraine, Chicago Wheat Futures traded 5 sessions in a row with a limit move taking place, all of which settled at the limit👇🏻

When futures contracts settle at their limit price any given day, the futures exchanges will use expanded limits for the very next trading session.

In the situation above, holders of long futures contracts were in good shape. They could easily sell their contracts any time when the market went limit up at the limit price for the day, if they chose to do so.

As for the holders of short futures contracts, if they were unable to liquidate their short position before the market went limit up, they would be stuck in a situation where they could not easily buy back their short position. Luckily for the short, when markets go limit they could very well hedge their position using options.

How?🤔

When the market trades limit, it only applies to futures contracts, but the options on futures market continues to trade. In the case of a short futures contract holder, they could go to options market and create a synthetic long futures position by simultaneously purchasing a call option and selling a put option with the same strike price and expiration of that commodity future. This synthetic long would help offset some exposure from holding short futures contracts.

Do all grain futures have price limits?

Grain futures contracts have no price limits when they are trading in the delivery month for the contract in delivery.

The Watchmen 📚

On the outskirts of the futures exchanges there is an important regulatory body called the Commodity Futures Trading Commission, or, CFTC for short. The CFTC is an independent federal regulatory agency that was created in 1974 and is tasked with overseeing and regulating U.S. derivatives markets.

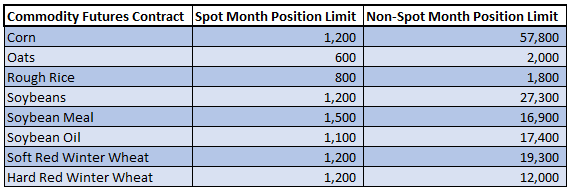

One of the responsibilities that the CFTC manages is the setting and enforcement of position limits on an array of futures contracts, which include grain futures. These position limits help prevent excessive speculation and market manipulation.

Presented below are contract position limits for the most popular U.S. grain futures contracts for both the spot month as well as the non-spot month(s).

If a firm or individual were to violate the above position limits, they could be fined by the CFTC. For example, the most recent position limit violation by a major grain company totaled over $400,000 in fines and unwanted press.

Most traders will never ever amass positions like these, but the position limits are important to know and understand what the competition is capable of. 💡

Participation Points 📊

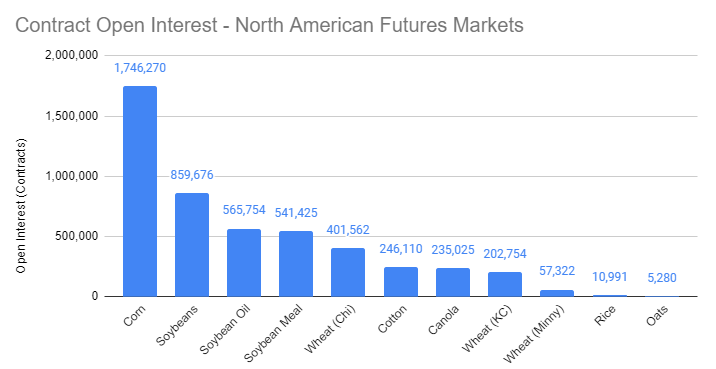

One of the most important indicators of the health of a futures contract is the open interest.

Open interest (OI) is the total number of open contracts at a given point in time for a given commodity. Open interest is a helpful gauge of the market because it quantifies the participation in the market. A large open interest means that participants are actively using the contract to hedge or speculate, which in turn improves the liquidity of a contract.

Below you can see the open interest rankings of North American Futures Contracts👇🏻

How is open interest calculated (Example)?👇🏻

Traders X, Y, and Z decide they want to start trading Wheat Futures

Trader X sells Trader Y, 10 futures contracts. (Open interest increases 10 contracts)

Trader Y sells Trader Z, 5 futures contracts. (Open interest does not change)

Trader Z sells Trader X, 5 futures contracts. (Open interest decreases 5 contracts)

Trader Y sells Trader X, 5 futures contracts. (Open interest decreases 5 contracts)Total open interest contribution: 10 - 0 - 5 -5 = 0 contracts are left outstanding

As the contracts changed hands in the example above, open interest changed and sometimes it didn’t. The important concept to understand here is that the rules of the game prevent artificial supply of futures contracts to be created or removed from the market.

This is why you might hear market participants explain that the futures market is a zero sum game, whereby:

For every buyer there is a seller

For every long there is a short

For every dollar made is a dollar lost

Closing Time⌛

This concludes Futures: Part IV of the Grain Trading Crash Course and the end of the Futures component of the course. The next section of the course will focus on risk management, trading, and the pricing of agricultural commodities.

We hope you enjoyed this lesson of the Grain Trading Crash Course. Remember to subscribe and leave a comment below if you enjoy the content we are providing to the community. Thank you! 🤠

really great lessons and easily understandable. Thank you

Great lessons!! Will you be doing another series?