🖐🏻 Five Charts In Five Minutes - The Return! 👀

Five charts that make us go "hmm, that's interesting 🤔"

Didn’t expect to see us on Substack again did you? 🙋♀️

Well, we’re back in action on Substack after a long hiatus and plan on continuing long and short form content for the foreseeable future.

Please be aware this is not the GrainStats of the past where we were limited to writing mainly about Grain Markets and Trading, we’re going off-script and blending much more into our writing routines than we have in the past.

So stick around and check in from time to time to see what we’re doing because it’s not going to be the usual run of things, we guarantee that 👀

*Copyright notice: All works on this blog (blog.GrainStats.com), the GrainStats.com domain, and the Commodity.Report domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Chart Time ⏱️

This week’s Five Charts in Five Minutes is dedicated to some of the biggest events that impacted the grain markets in the 2020s.

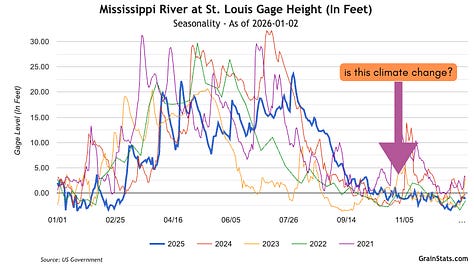

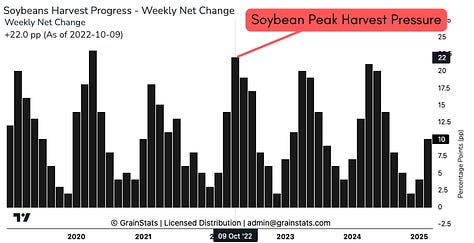

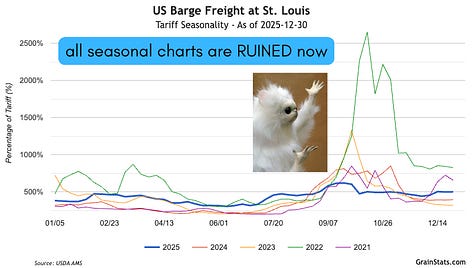

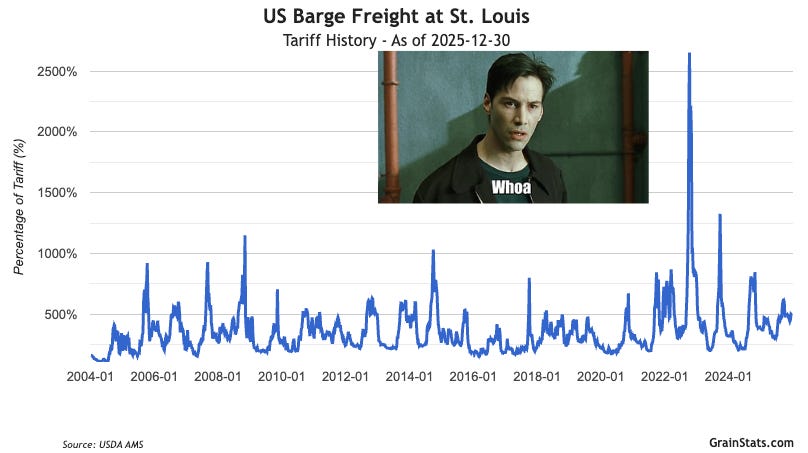

Chart #1 - The Barge Freight Explosion of 2022 ⚓️🚀

What happens when you mix peak Soybean harvest, a sizable river-export program, and extremely low water levels at the same time? ♻️

The answer is an unprecedented move in Barge Freight which created a generational “Trader PTSD” not seen since the drought of 2012 👇

Past is past, but why does this phenomenon of low water levels continue to happen around the peak soybean harvest window? Maybe that should be something these land-grant universities should be investigating 💡

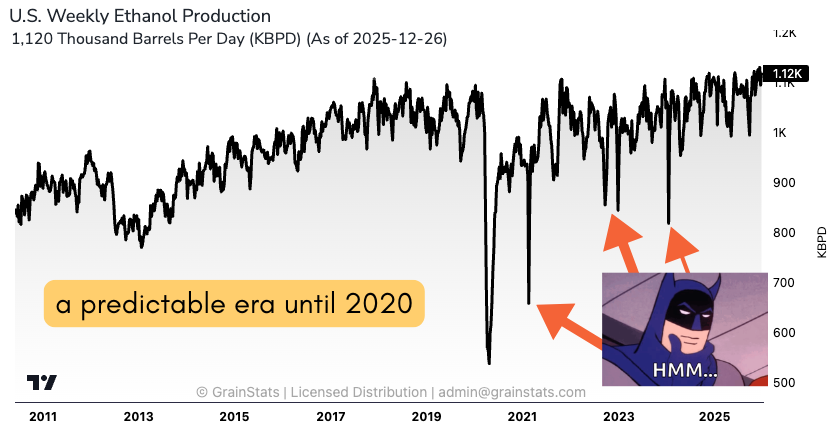

Chart #2 - Ethanol Production Volatility Post-COVID ⛽️🌽♻️

I was minding my own business just yesterday updating some tools for GrainStats V2 and stumbled upon one of our charts on long-term ethanol production. I was looking at it in detail and thought to myself,

Why is ethanol production so volatile post-2020? 🤔

Everyone already knows what happened in 2020, so we’re not going to ask, but there were 3 serious production events after 2020 which were mostly related to freezing temps + natural gas prices (from my hazy memory.)

One can only wonder if this is the new norm? And if it is, what are the second order implications of the AI/data center buildouts in the midwest that rely on natural gas to power their operations?

Who is going to shut down first during the next midwestern freeze?

AI Bros or Ethanol Bros? 🤔

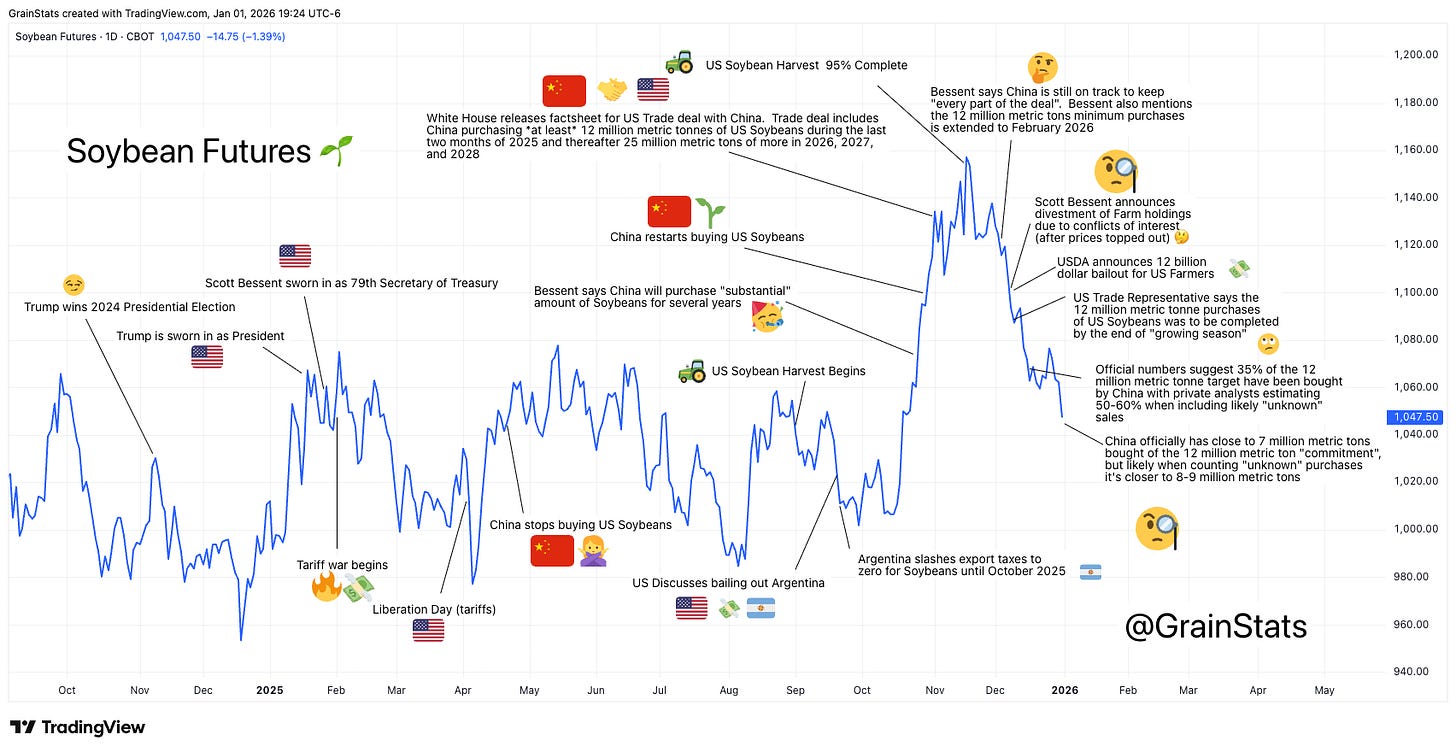

Chart #3 - The Soybean Goal Posts 📈📉🌱

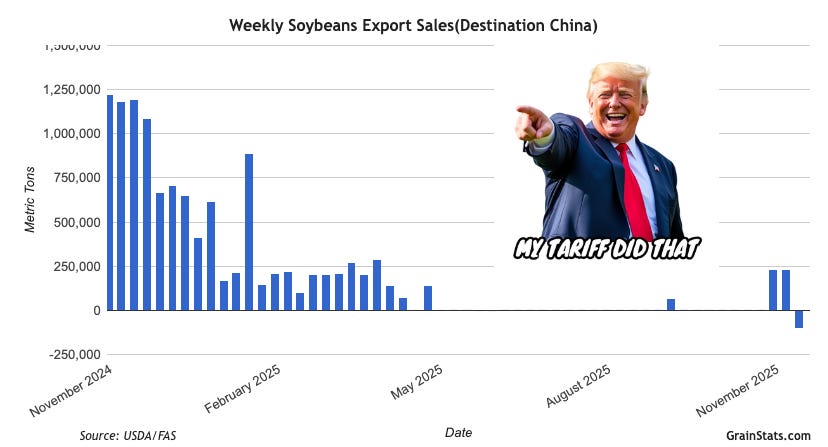

Going into 2025 US Soybean Farmers were already positioned knowing that at any moment they could get the rug pulled out from under them, and boy they did 📉

For a good 6 months, China literally went no-bid US soybeans forcing many export-dependent areas like North Dakota to see their soybean bids drop like a rock. That triggered pre-bailout talks for farmers and pressure on the Trump administration to “do something”.

In response they sent their best and brightest to make a deal with China. But the person they sent was actually a North Dakota farmer by the name of Scott Bessent, aka US Treasury Secretary Bessent.

Jokes aside, Scott Bessent owned (at the time) millions of dollars of land in North Dakota, so he had a vested interest in the deal himself to make it right.

What he allegedly got China to agree to was the following:

China will purchase at least 12 million metric tons (MMT) of U.S. soybeans during the last two months of 2025 and also purchase at least 25 MMT of U.S. soybeans in each of 2026, 2027, and 2028. - White House Official Statement

This statement, specifically the purchase of 12 million metric tons of soybeans is what ignited the soybean futures rocket ship and led to one of the largest non-supply driven moves the soybean market has ever(?) seen.

Below you can see a timeline of events of how it all unfolded and exactly how the administration shifted the goalposts from “end of 2025” to “end of February 2026”, which was the last exit in faith for the overall deal, because what’s the point in a deal if they keep on shifting the goalposts around?

Chart #4 - Wheat Limit Up ⬆️⬆️⬆️

There was a time when wheat prices went up and kept on going up, believe it or not. Sadly, it was on account of Russia invading Ukraine in February 2022. Many lives were lost, wheat went limit-up, and the physical markets froze.

In the end, the trade figured out how to trade in the Black Sea and how Ukraine could export its grain westbound into Europe, but before that it ripped many margin accounts in half with the daily limit moves (five of them in a row.)

Chart #5 - The Grain Must Flow 🤷♀️

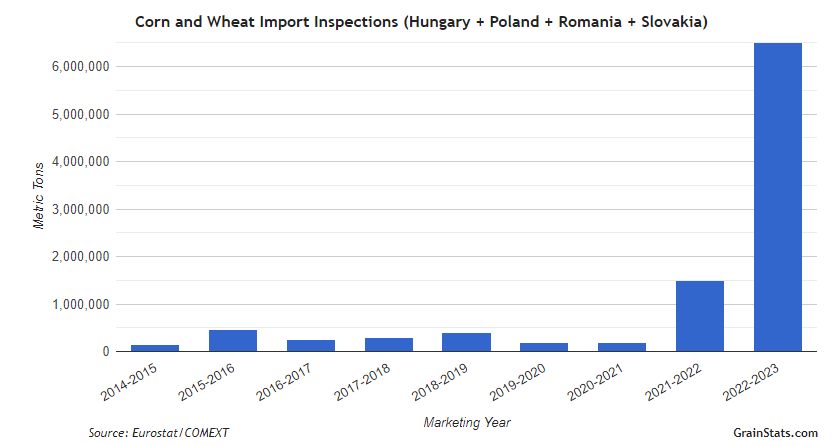

In continuation of the Russia-Ukraine war and the trade “figuring it out”, we saw unprecedented grain shipments move into Ukraine’s adjacent neighbors - Hungary, Poland, Romania, and Slovakia.

This made entirely no sense at all for the well-being of those farmers in those countries as they were now competing with grain that was sold at fire sale prices.

This continued for some time, and outrage only grew along with other trade restrictions. Luckily, Ukraine returned to exporting more grain out of the Black Sea and prices stabilized, but the damage was definitely felt in lives lost and wallets emptied.

Closing Time ⌛

This concludes our first Substack post in about two years and we’re just getting back in the swing of things. Be on the lookout for more short and long-form, serious but fun content. You know we’re good for it 💯

Yo!

Looking forward to it!