🖐🏻Five Charts In Five Minutes #7

High level technical analysis of the most popular grain and oilseed futures contracts.

At least once a week we go over light technical analysis of grain and oilseed futures contracts. Subscribe to our newsletter, join our Telegram channel, or watch for our Twitter updates for latest posts. Feel free to manage your subscriber preferences at the bottom of this e-mail to fine tune which topics you wish to be subscribed to.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Corn Futures 🌽

Corn made a major break above the trend early last week. Unfortunately, the positive momentum could not keep the gains intact. It appears now that the trend is stuck in a sideways trading pattern in between two opposing trend lines. Probably the best move in the market is to sit and watch what happens at the fringes and see if there is any follow through to this market.

🟢Current upside targets: 6.85, and 6.89

🔴Current downside targets: 6.61, 6.55, and 6.50

Wheat Futures 🌾

Wheat continues to bleed out taking out support levels almost weekly. We believe with the close below the support level of 7.24, wheat might be ready to punish the market even more with a target set @ 6.92. We’ll be watching for liquidations and a potential turnaround from there.

🟢Current upside targets: 7.40 and 7.50

🔴Current downside targets: 6.92 and 6.87

Soybean Futures🌱

Soybeans have been under pressure after taking out our target of 15.45 last week. With the observed rains in Argentina and the selloff across the board late last week into this week, we question if the market has enough momentum to get back to higher levels. At the moment we feel that is not the case and are patiently waiting for confirmation from the market. For the week, the trade will be talking about the recent gap on the chart at 15.04, which needs to be tested soon to get us back to higher levels.

🟢Current upside targets: 15.04 and 15.21

🔴Current downside targets: 14.80 and 14.65

⚠️ Mind the gap @ 15.04

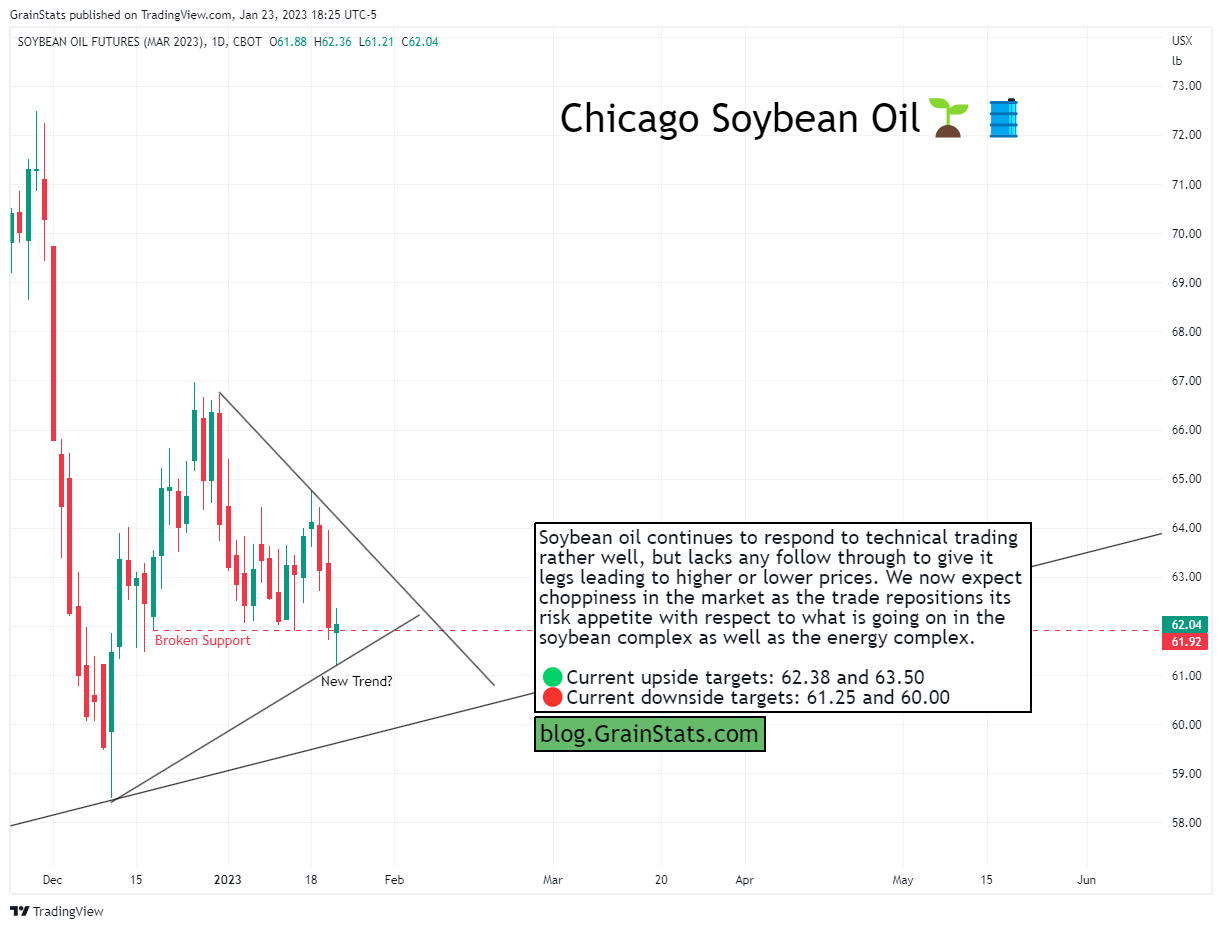

Soybean Oil Futures 🌱🛢️

Soybean oil continues to respond to technical trading rather well, but lacks any follow through to give it legs leading to higher or lower prices. We now expect choppiness in the market as the trade repositions its risk appetite with respect to what is going on in the soybean complex as well as the energy complex.

🟢Current upside targets: 62.38 and 63.50

🔴Current downside targets: 61.25 and 60.00

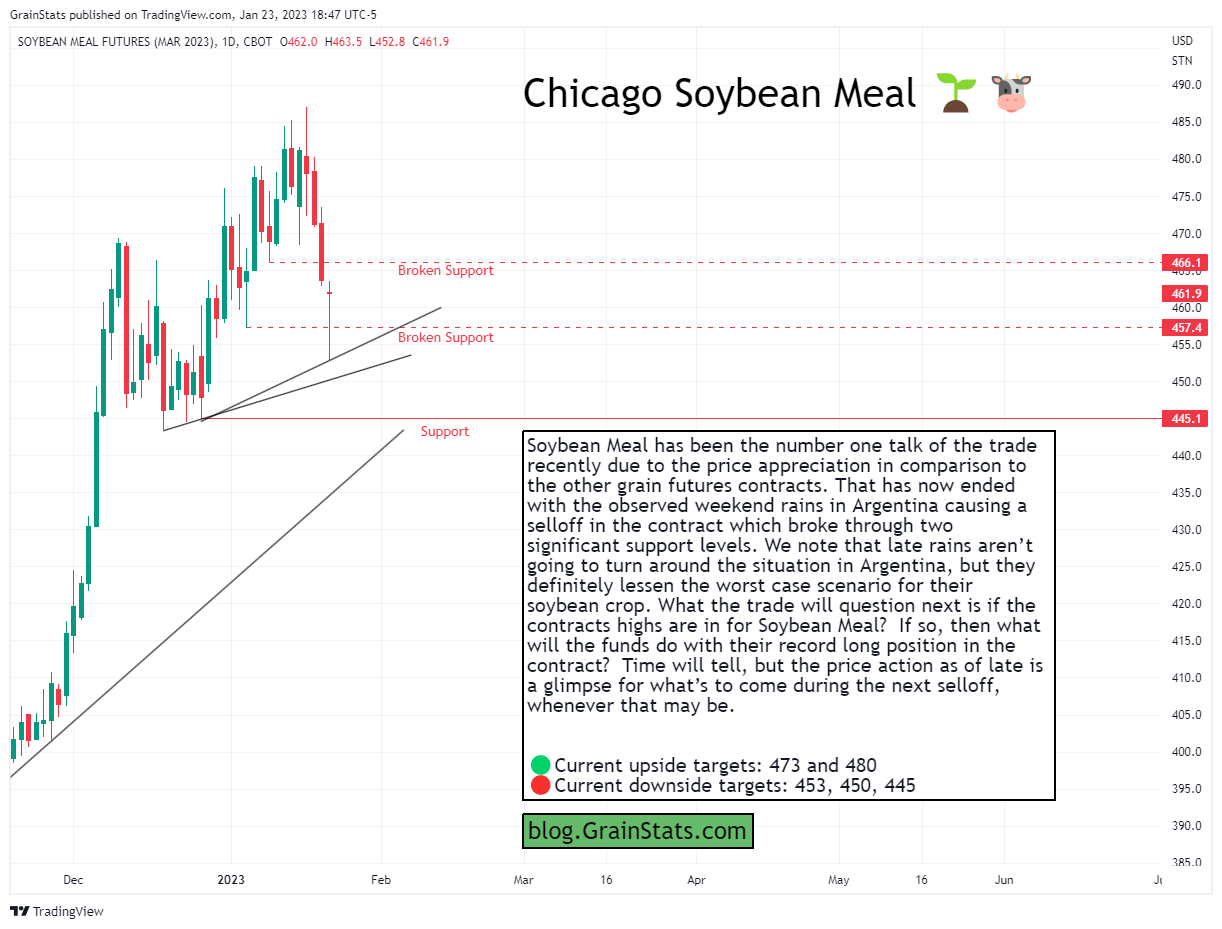

Soybean Meal Futures🌱🐮

Soybean Meal has been the number one talk of the trade recently due to the price appreciation in comparison to the other grain futures contracts. That has now ended with the observed weekend rains in Argentina causing a selloff in the contract which broke through two significant support levels. We note that late rains aren’t going to turn around the situation in Argentina, but they definitely lessen the worst case scenario for their soybean crop. What the trade will question next is if the contracts highs are in for Soybean Meal? If so, then what will the funds do with their record long position in the contract? Time will tell, but the price action as of late is a glimpse for what’s to come during the next selloff, whenever that may be.

🟢Current upside targets: 473 and 480

🔴Current downside targets: 453, 450, 445

TLDR

The trade is still digesting the recent price action in the grains and oilseed futures contracts for hints to where the market will go. The main concern that seems to be floating around is "are the highs in?” If so, then what will the funds do with their record long position in soybean meal? Time will tell, but the price action today is just a glimpse of what may be to come the next time a major selloff begins.