🖐🏻Five Charts In Five Minutes #6

High level technical analysis of the most popular grain and oilseed futures contracts.

At least once a week we go over light technical analysis of grain and oilseed futures contracts. Subscribe to our newsletter, join our Telegram channel, or watch for our Twitter updates for latest posts. Feel free to manage your subscriber preferences at the bottom of this e-mail to fine tune which topics you wish to be subscribed to.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

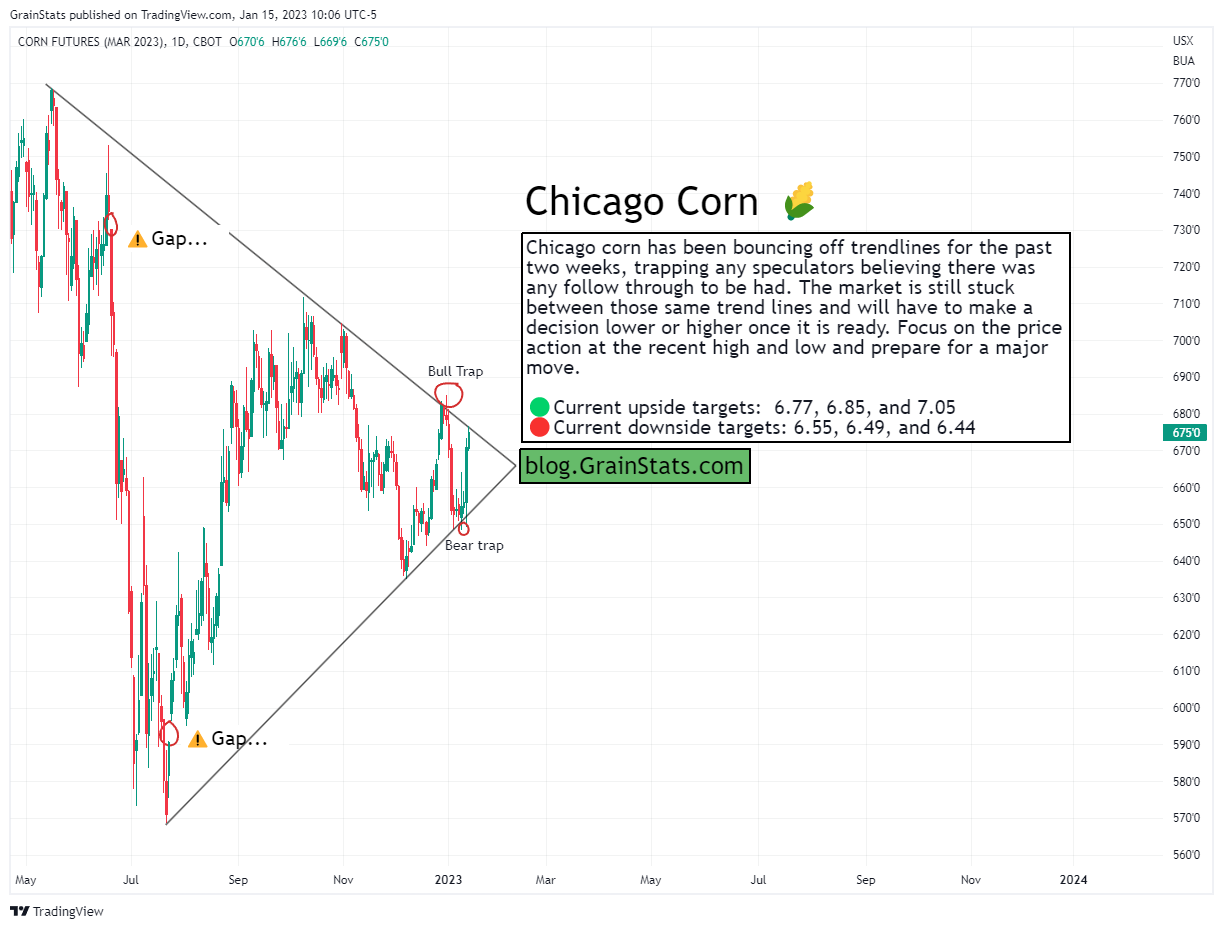

Corn Futures 🌽

Chicago corn has been bouncing off trendlines for the past two weeks, trapping any speculators believing there was any follow through to be had. The market is still stuck between those same trend lines and will have to make a decision lower or higher once it is ready. Focus on the price action at the recent high and low and prepare for a major move.

🟢Current upside targets: 6.77, 6.85, and 7.05

🔴Current downside targets: 6.55, 6.49, and 6.44

Wheat Futures 🌾

Support levels were breached at 7.23 last week but did not fully break lower after that. 7.24 to 7.20 now holds as support for the time being. Overall, the theme in the markets has been lower prices for quite some time and the trendlines confirm it. We don’t know when or how the trend will reverse, but for now, be aware it exists and it crushes any rally that starts to materialize. Even the funds have exited their bullish bets and are net short all wheat contracts that trade on US Exchanges.

🟢Current upside targets: 7.58, 7.63, and 8.00

🔴Current downside targets: 7.24 and 6.92

Soybean Futures🌱

It sounds like a broken record at this point, but the soybean market is still assessing the supply/demand situation in South America with Brazil expected to harvest a record crop and Argentina expected to have a +5 year low in production. Regardless of how the fundamentals play out, if you’re a bull, you better hope that Soybeans exhibit enough strength to break the local high of 15.37 and attempt to trade the pocket of open air above it rather quickly, otherwise gravity may bring us back to the uptrend line which continues to be tested.

🟢Current upside targets: 15.37 and 15.45

🔴Current downside targets: 14.86 and 14.64

Soybean Oil Futures 🌱🛢️

Prior to the WASDE report last week, soybean oil broke the near term uptrend established by the market. After the WASDE report was released, soybean oil futures turned around and went bid, aided by the strength in grains and energies markets. The focus in soybean oil should be centered on the downtrend established early in December and the near term support established last week and how to play it if either gets breached.

🟢Current upside targets: 63.74, 64.50, and 65.50

🔴Current downside targets: 62, 61.50, and 60

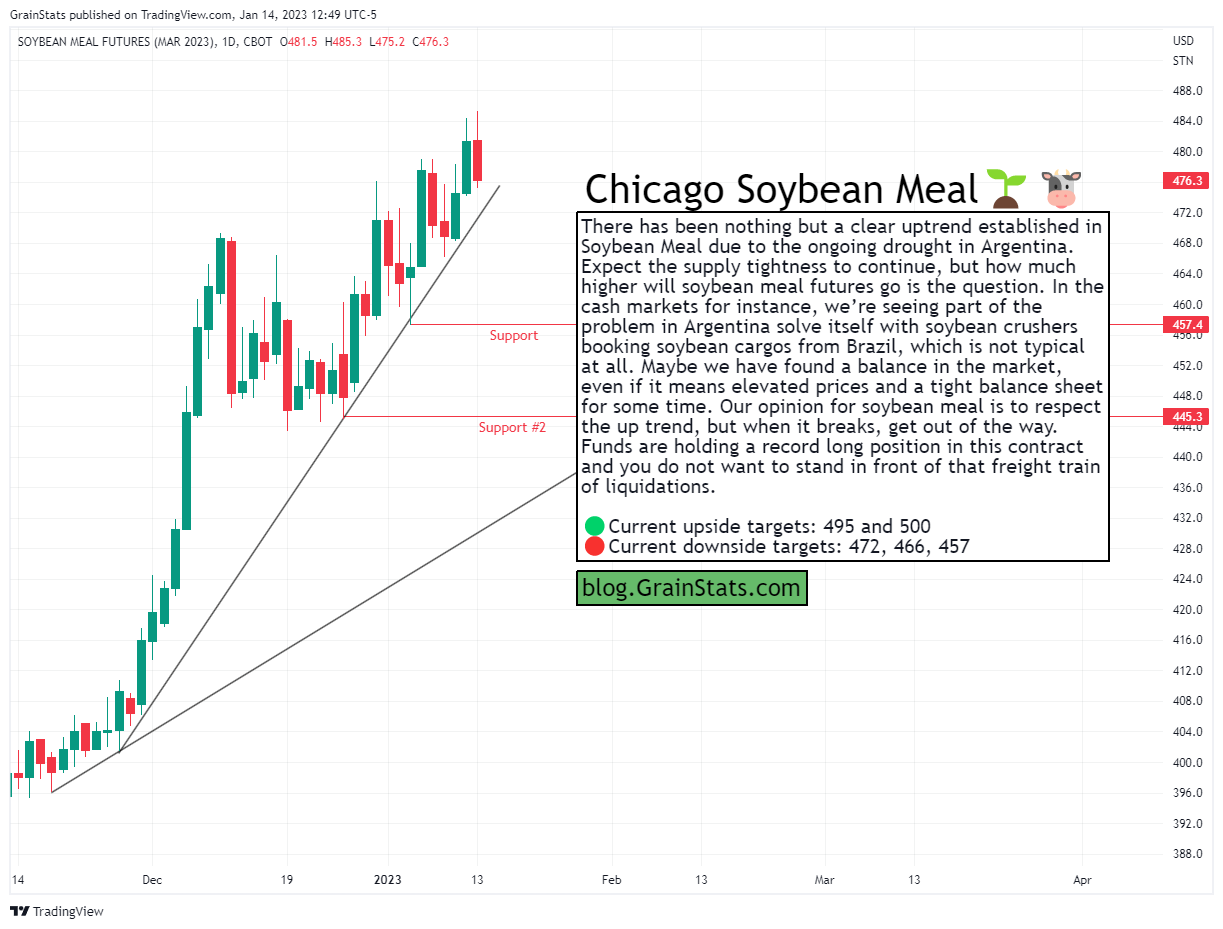

Soybean Meal Futures🌱🐮

There has been nothing but a clear uptrend established in Soybean Meal due to the ongoing drought in Argentina. Expect the supply tightness to continue, but how much higher will soybean meal futures go is the question. In the cash markets for instance, we’re seeing part of the problem in Argentina solve itself with soybean crushers booking soybean cargos from Brazil, which is not typical at all. Maybe we have found a balance in the market, even if it means elevated prices and a tight balance sheet for some time. Our opinion for soybean meal is to respect the up trend, but when it breaks, get out of the way. Funds are holding a record long position in this contract and you do not want to stand in front of that freight train of liquidations.

🟢Current upside targets: 495 and 500

🔴Current downside targets: 472, 466, 457

TLDR

The trade will continue to be focused on the South American production narrative, but that story is mostly priced in at this point. We believe the next theme of the markets will be demand driven with the trade focusing on logistics as Brazil shift gears from exporting Corn to mostly Soybeans. Be watchful for chatter in the market indicating brokered sales as well as USDA weekly and daily flash sales for an indication of trade flow. Until then, stick to the charts.

📌Reminder: Grain markets are closed today (Monday 1/16) in celebration of Dr. Martin Luther King Day and will re-open tonight (1/16) at 7pm Chicago time. US Government reports will also be delayed by one day by most Government statistics agencies.

Thanks!

Thanks!