🖐🏻Five Charts In Five Minutes #4

High level technical analysis of the most popular grain and oilseed futures contracts.

At least once a week we go over light technical analysis of grain and oilseed futures contracts. Subscribe to our mailing list or watch for our Twitter updates for latest posts. Feel free to manage your subscriber preferences at the bottom of the e-mail to fine tune the e-mails that you wish to receive.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Corn Futures 🌽

Corn joined soybeans in the rally last week breaking all targets we anticipated. A word of caution, the price action behaved so well that it may have been overdone, creating a possible bull trap above the down trend line. We will be watching this week if indeed that is the case or we revert upwards. From the downside point of view, we have a decent upward trend that will be defended by the bulls. Respect it.

🟢Current upside target is 7.05, then 7.11

🔴Current downside target is 6.60, then 6.55

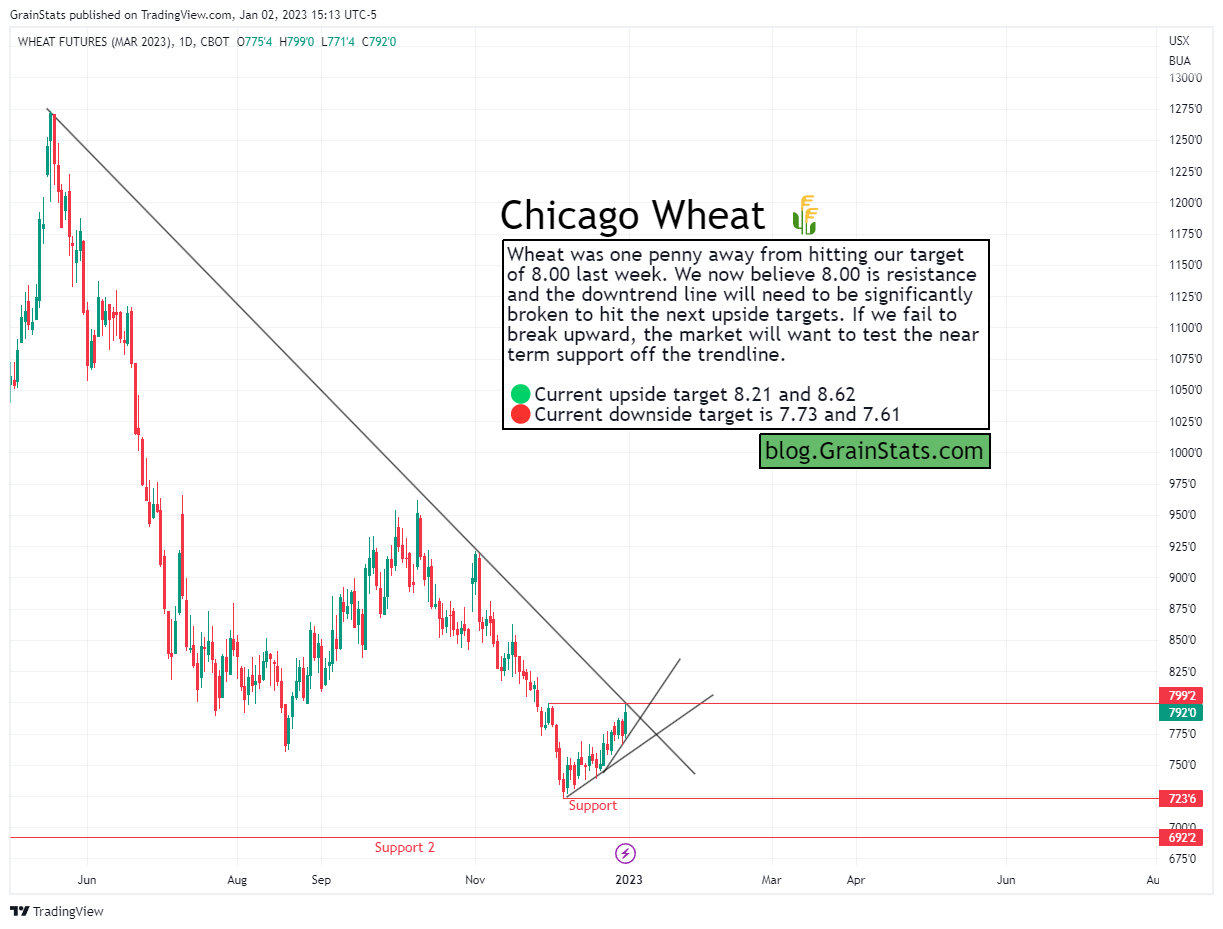

Wheat Futures 🌾

Wheat was one penny away from hitting our target of 8.00 last week. We now believe 8.00 is resistance and the downtrend line will need to be significantly broken to hit the next upside targets. If we fail to break upward, the market will want to test the near term support off the trendline.

🟢Current upside target 8.21 and 8.62

🔴Current downside target is 7.73 and 7.61

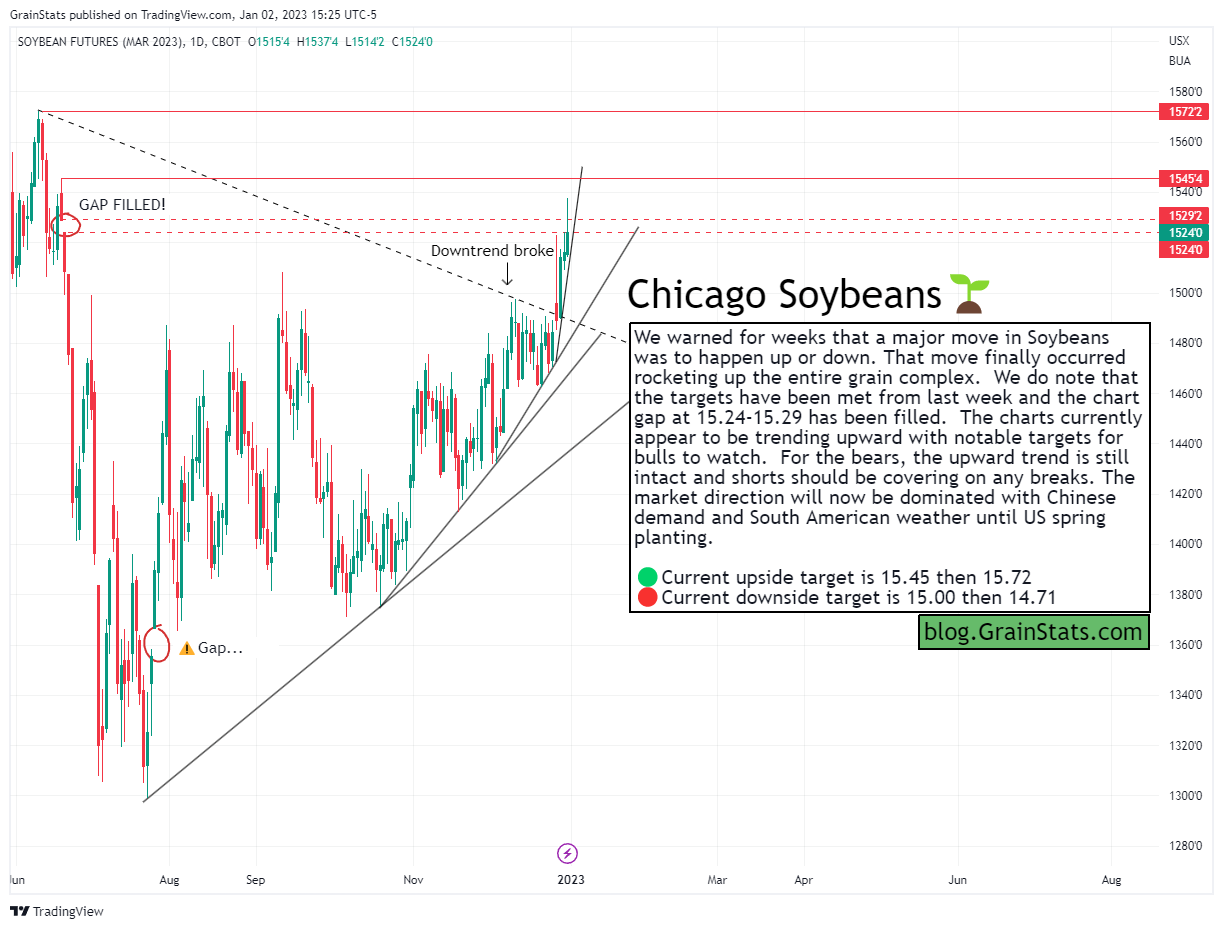

Soybean Futures🌱

We warned for weeks that a major move in Soybeans was to happen up or down. That move finally occurred rocketing up the entire grain complex. We do note that the targets have been met from last week and the chart gap at 15.24-15.29 has been filled. The charts currently appear to be trending upward with notable targets for bulls to watch. For the bears, the upward trend is still intact and shorts should be covering on any breaks. The market direction will now be dominated with Chinese demand and South American weather until US spring planting.

🟢Current upside target is 15.45 then 15.72

🔴Current downside target is 15.00 then 14.71

Soybean Oil Futures 🌱🛢️

Soybean Oil rode on the coattails of Soybeans and hit our target of 67 last week. Afterward, gravity pushed it lower and it broke its near term uptrend. Most of this was due to a short squeeze with funds re-initiating long positions. The chart now tells us that 67 is resistance and we have a new downtrend line reminding us what happened with the EPA biofuels decision several weeks ago.

🟢Current upside target is 67

🔴Current downside target is 63.50 and 61.50

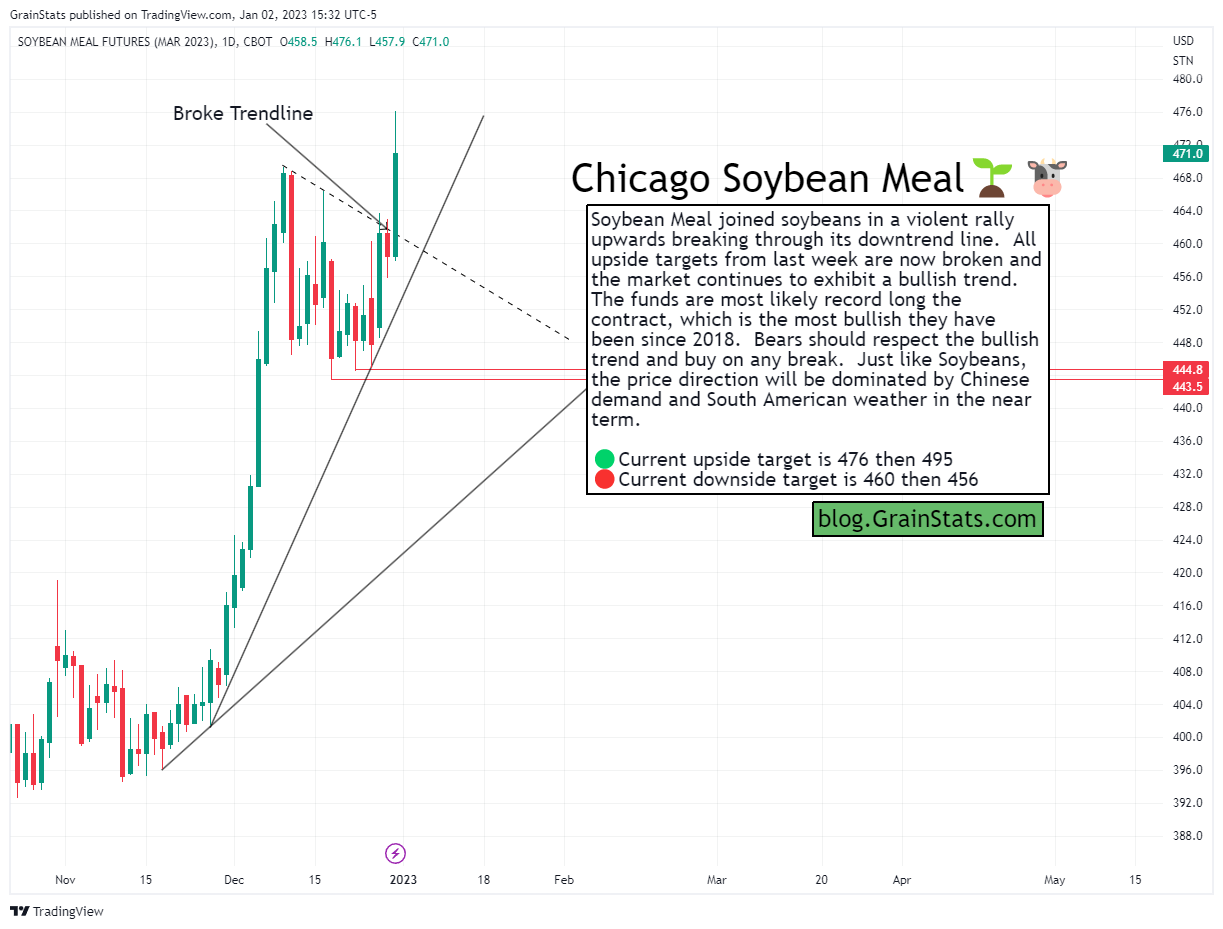

Soybean Meal Futures🌱🐮

Soybean Meal joined soybeans in a violent rally upwards breaking through its downtrend line. All upside targets from last week are now broken and the market continues to exhibit a bullish trend. The funds are most likely record long the contract, which is the most bullish they have been since 2018. Bears should respect the bullish trend and buy on any break. Just like Soybeans, the price direction will be dominated by Chinese demand and South American weather in the near term.

🟢Current upside target is 476 then 495

🔴Current downside target is 460 then 456

TLDR

Traders were positioned well to take advantage of the large move that happened last week. This week, the charts aren’t setting themselves up for such an enormous move and the setups aren’t as clear. In general, the strength seems to be coming from Soybean and Soybean Meal which spills over into Corn and Wheat. As long as that’s the case, we’re putting our Soybean🌱 trading hats on.

Check our Twitter or Telegram for updates on South American weather before the open tomorrow. Good luck!