🖐🏻Five Charts In Five Minutes #12

High level technical analysis of the most popular grain and oilseed futures contracts.

At least once a week we go over light technical analysis of grain and oilseed futures contracts. Subscribe to our newsletter, join our Telegram channel, or watch for our Twitter updates for latest posts. Feel free to manage your subscriber preferences at the bottom of this e-mail to fine tune which topics you wish to be subscribed to.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Corn Futures 🌽

Corn has finally made a move that we have been waiting for (up or down) and has broken two significant bullish trend lines late last week. We note that the only significant support on the chart is at 6.37 and is within striking distance. Watch for continued fund liquidations this week as the market is looking to bottom out and establish a local low on the charts.

🟢Current upside target: 6.50

🔴Current downside targets: 6.40 and 6.37

Wheat Futures 🌾

Wheat has successfully broken out of its trading range and settled below the 7.20 level. This has opened the door to lower prices in the near term. Support is noted at 7.04, 7.00 (psychological), and 6.83. Watch for direction in the market to come from Corn and Soybeans which continue to appear in liquidation mode.

🟢Current upside target: 7.25

🔴Current downside targets: 7.04, 7.00

Soybean Futures🌱

Soybeans have failed to propel themselves into a new pricing regime last week and instead broke through their local bullish trend line as well as closed the price gap. These events are not bullish and further testing of the bullish trend appears in the cards. Be also on the lookout at 15.00 IF the market decides to go there.

🟢Current upside target: 15.25

🔴Current downside targets: 15.03, 15.00, 14.77

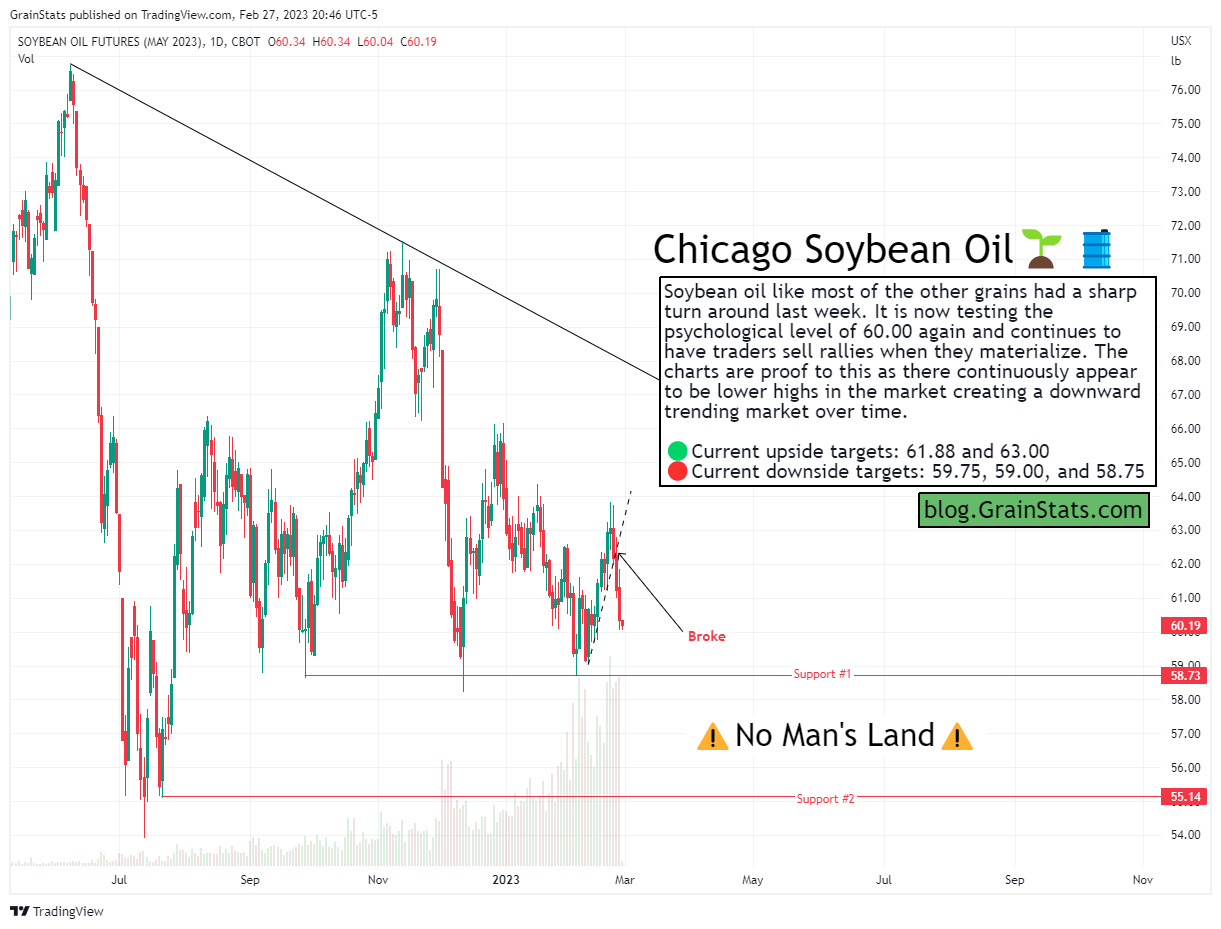

Soybean Oil Futures 🌱🛢

Soybean oil like most of the other grains had a sharp turn around last week. It is now testing the psychological level of 60.00 again and continues to have traders sell rallies when they materialize. The charts are proof to this as there continuously appear to be lower highs in the market creating a downward trending market over time.

🟢Current upside targets: 61.88 and 63.00

🔴Current downside targets: 59.75, 59.00, and 58.75

Soybean Meal Futures🌱🐮

No commentary this week. Watch the levels this week for direction.

🟢Current upside target: 485

🔴Current downside targets: 473 and 471

TLDR

Markets appear in liquidation mode and are looking to “bottom out” and establish support until the next bullish or bearish narrative materializes. Until that happens, be on the lookout for key support levels and psychological levels mentioned above to be tested.