Five Charts In Five Minutes #1

High level technical analysis of the most popular grain and oilseed futures contracts.

At least once a week we go over light technical analysis of grain and oilseed futures contracts. Subscribe to our mailing list or watch for our Twitter updates for latest posts. Feel free to manage your subscriber preferences at the bottom of the e-mail to fine tune the e-mails that you wish to receive.

*Copyright notice: All works on this blog (blog.GrainStats.com) and the GrainStats.com domain are copyright protected and may not be duplicated, disseminated, or appropriated.

Corn Futures 🌽

Corn appears to be trading sideways with defined support levels. A major downtrend line for 2022 seems to burden every market rally. Be watchful if we break above the near term downtrend line.

🟢Current upside target is 6.74

🔴Current downside target is 6.35

⚠️Mind the gap below 5.95

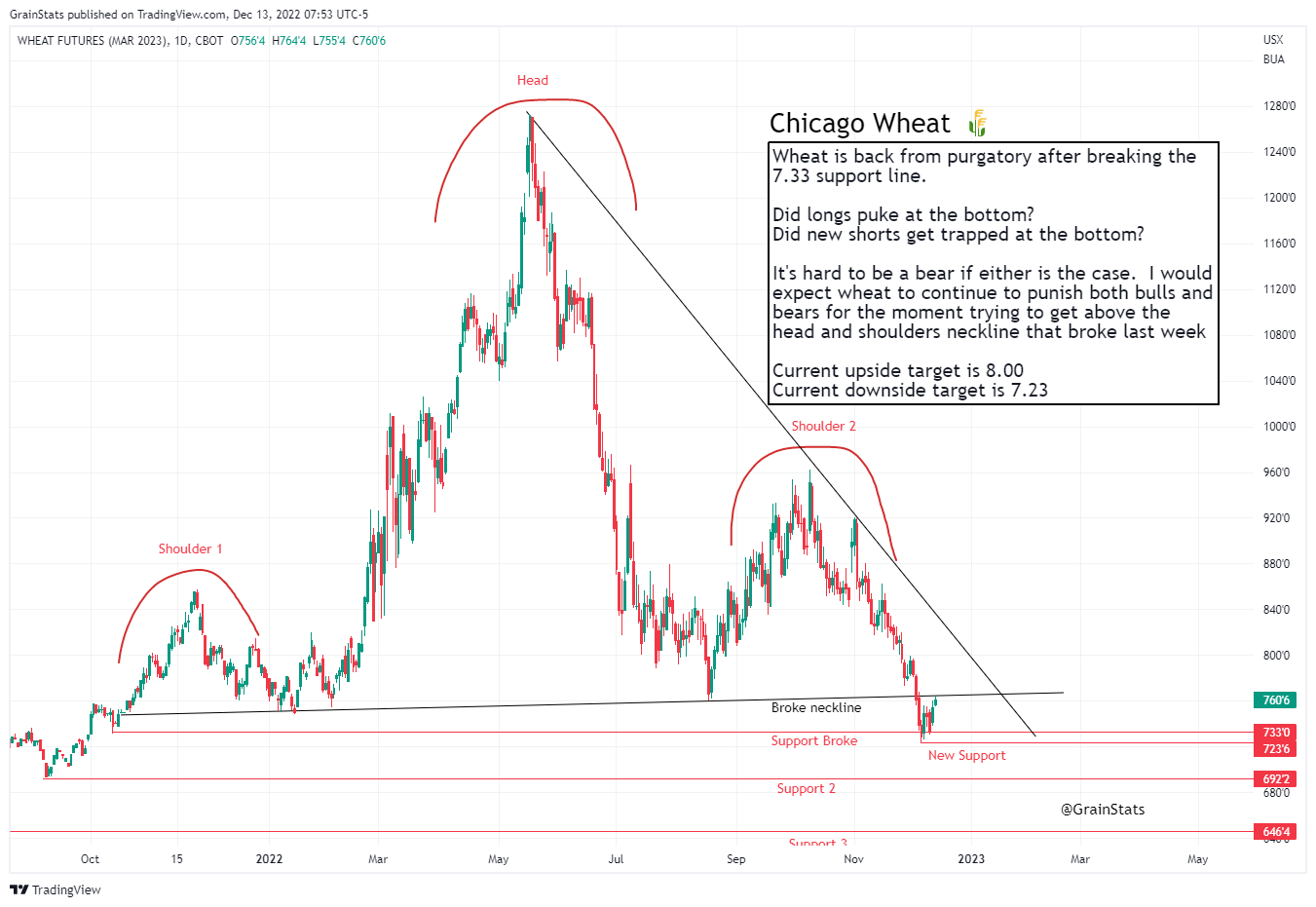

Wheat Futures 🌾

Wheat is back from purgatory after breaking the 7.33 support line.

Did longs puke at the bottom?

Did new shorts get trapped at the bottom?It's hard to be a bear if either is the case. I would expect wheat to continue to punish both bulls and bears for the moment trying to get above the head and shoulders neckline that broke last week.

🟢Current upside target is 8.00

🔴Current downside target is 7.23

Soybean Futures🌱

Soybeans have been supported by South American weather and Soybean Meal strength. A big decision will have to be made soon in the market as we're in between two trendlines. Expect volatility.

🟢Current upside target is 14.92

🔴Current downside target is 14.58 and 14.25

⚠️Mind the gap above 15.36

Soybean Oil 🌱🛢️

Soybean oil has been in liquidation mode for the past two weeks shredding over 15% of its value. The bear case seems to have paused with funds reporting the largest weekly liquidation in futures contracts since 2017. We believe the low of 59 was panic selling and the market is now neutral to bullish.

🟢Current upside target is 67.33

🔴Current downside target is 60

⚠️Mind the gap at 67

Soybean Meal 🌱🐮

Soybean meal has taken its share back in the crush and helping hold the grains complex together. The move after the EPA decision feels over done, but still bullish overall. We would watch for potential long liquidations below the recent lows @ 447-448. Watch for rains in Argentina to determine if this rally continues to have legs.

🟢Current upside target is 462

🔴Current downside target is 447-448

TLDR;

Grain and oilseed futures seem to be telling us that the near term liquidation of futures contracts is over, profit taking is looming in the background in the strongest contract (soybean meal), and we are generally trading sideways at the mercy of crop production issues in South America.

Charts were made using TradingView.

Good Stuff